Build a Resilient Supply Chain with Deep Financing Tokens

Our platform leverages Deep financing tokens through receivable tokenization, empowering the leading banks and corporates with blockchain-enhanced finance solutions.

Broad Market Access

Open doors to new market segments, including the SMEs often overlooked by traditional finance.

Risk Reduction

Mitigate financial risks with blockchain's inherent security and transparency.

Supply Chain Strength

Build a more resilient supply chain with efficient, transparent financial practices.

Optimize your Supply Chain with our blockchain-based Deep Finance Tokens.

Supply chain financing faces hurdles like opaque credit assessments, slow approvals, and high transaction costs, often leaving small and medium-sized enterprises (SMEs) with high borrowing rates and limited access to capital. Deep Financing Tokens (DFT) provide a powerful blockchain solution for banks, NBFCs, and fintech firms, enhancing liquidity, fostering growth, and improving efficiency in Supply Chain Finance.

Smart Contracts

Automate invoice financing and credit disbursements & ensure unbiased, tamper-proof, and efficient settlements.

Decentralized Ledger

Maintain a transparent, secure, and immutable record of invoices and credit scores giving real-time access to stakeholders.

Reduced Transaction Costs

Eliminate intermediaries and paperwork, reducing transaction costs by up to 70%.

Lower Credit Risks

Tokenized financing and transparent ledgers minimize credit risks and fraudulent transactions.

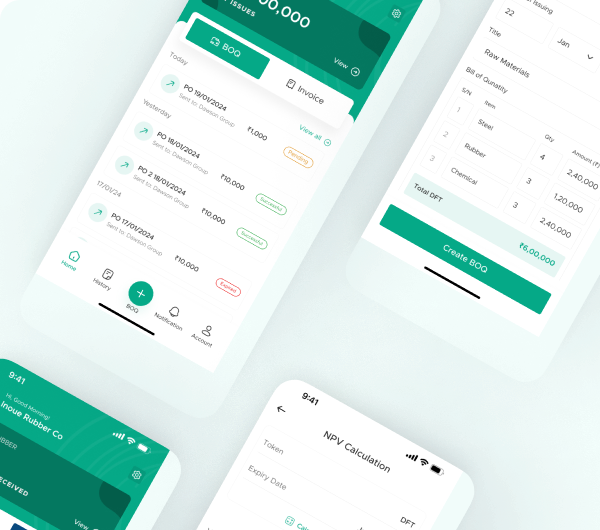

How it works?

Discovering simplicity in action. Follow these easy steps to optimize your Supply Chain operations with DFT in 3 Easy Steps.

Tokenize Receivables

Tokenize invoices, credit profiles, and inventory assets on a secure blockchain, ensuring complete encryption and immutability.

Seamless Integration

Integrate our platform with your existing financial systems, making the transition smooth and straightforward. Automate financing using smart contracts to ensure accurate, unbiased, and timely disbursements.

Real-Time Tracking

Monitor credit performance, identify potential risks, and optimize financing through real-time analytics.

Features

Supply chain finance providers offer numerous advantages over traditional financing methods. Here are some key benefits to consider:

Invoice Tokenization

Increased Liquidity for SMEs

Enhanced Transparency and Security

Automated KYC process reducing Onboarding Time

Greater Transparency and Risk Management

Reduced Financial Risks

Efficient Capital Flow

Access to Alternative Financing

Get Started with Dhara

Are you ready to take your supply chain finance to the next level? Join the financial revolution with Dhara and unlock new growth opportunities.

Contact us today to learn more about Dhara and how to empower your business.

Frequently Asked Questions

Here is the list of FAQ's about us and how we work. Got more questions? Feel free to reach us out